By Jeff Metzger

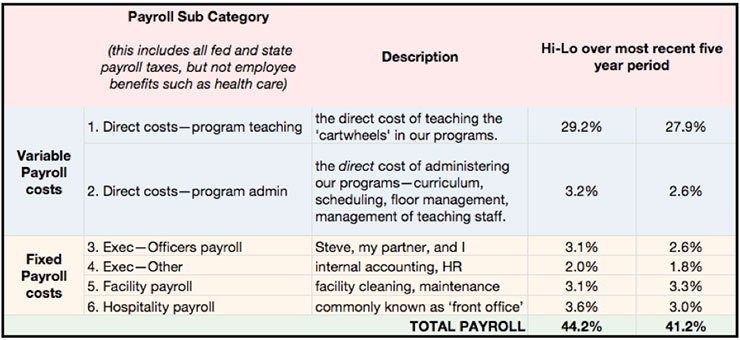

In Part 1 I wrote about how to analyze your P&L. Among other points, I stressed the need to FORGET ABOUT DOLLARS AND FOCUS ON PERCENTAGES, in particular, comparing various expense categories to total revenue. One example I gave was that in many gymnastics schools, the total payroll (including payroll taxes) often represents about 50¢ of every revenue dollar (50%). I suggested that 50% payroll/total revenue might be a good target for gymnastics schools that have a team program and that 45% might be a good target for schools having non-competitive only. (Remember, each business has its own financial dynamics and a target margin that is good for one business may not be good for another.) I am right now focusing on ‘total payroll’ for one simple reason—most gymnastics school’s accounting systems are organized to gather that data. However, at Kids First Sports Center we do NOT focus on total payroll. In fact, while writing Part 1, to learn our total payroll I literally had to get out my handy-dandy calculator and add six payroll sub categories as you see below:

(Note: As you notice, Kids First’s total payroll is less than the targets written of above. That is due to the economies of scale we gain from our model that has two dozen profit centers supporting fixed payroll costs.)

It doesn’t take a lot of deep thought to see the very large cumulative benefit of this different approach to accounting. Trying to find the ‘culprit’ when your business’s total payroll creeps up 1% is like hunting for a needle in a haystack. It is far easier and less time consuming to simply proactively continually monitor the sub categories, watching for tiny blips before things get out of had.

Of course, every yin has a yang and the clear downside to adopting this more granular approach is the time it takes to re-jigger your accounting system. So, the pivotal question becomes: is the payoff worth the pain? Emphatically, yes! I cannot imagine managing Kids First with the more conventional aforementioned way of accounting. And today, with Quickbooks or the like and a computerized payroll system, the above method is very doable. Fair warning: Don’t expect immediate results. It took us three years period before our information looked the way we wanted and now, after ten years, we are still fine tuning.

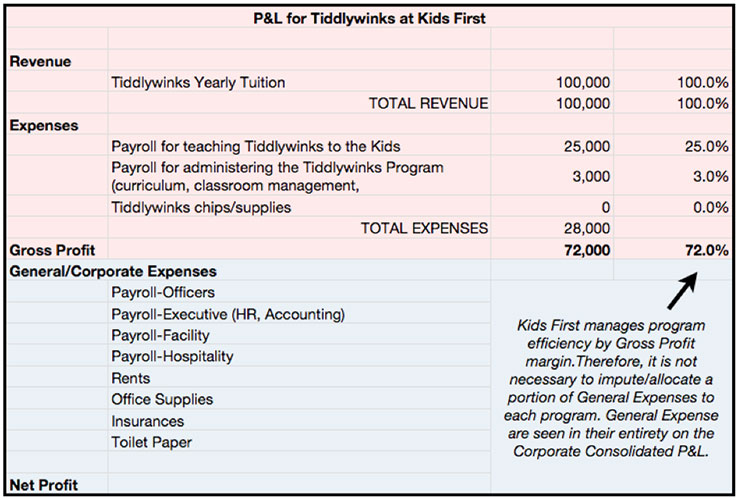

Diving deeper: Now I want to peek even deeper under the hood of our accounting system. As this article’s title states, I dub our accounting system a Gross Profit Based system. At Kids First, a program’s Gross Profit means everything. Well, to say it is ‘everything’ is over-exaggerating but Gross Profit margin surely means a LOT, as it is one of the two most important management numbers in our Company.

Our Gross Profit Based accounting system explained in plain words:

- We capture EVERY TUITION DOLLAR and allocate it to its proper program.

- We capture EVERY WAGE DOLLAR and allocate it to its proper program.

- Then, in each program, we subtract Revenue minus wages to find the GROSS PROFIT.

- Lastly we derive the GROSS PROFIT MARGIN by dividing the Gross Profit by the Total Revenue.

To be clear, said in different words, we don’t mix revenues nor do we mix expenses, program to program. Obviously, doing this requires that your classroom management system be able to accurately allocate the revenue dollars on the front end and that your payroll system be able to accurately allocate wage dollars on the back end. (You can expect this to require significant employee training).

By way of example, take a look at the P&L from our Tiddlywinks Program. (Yes, I am teasing. Once, in an article I referred to the Kids First ‘Spelunking Program’ and for years people asked me how our cave exploration program was doing :-)

Please take a careful few minutes to read and ASSIMILATE this P&L. Study it long enough to generate questions. Then read on.

As the arrow indicates, we focus on the Gross Profit margin (%). As I said earlier, we do not have a Tiddlywinks program. However, if we did, our target Gross Profit Margin would be somewhere near 72%. Through the years, we have learned that 72% is a good year-end target for a class program. Team programs will have different targets, say, around: 50% for optionals; 65% for compulsories; 75% for developmental team.

Again, it should be fairly easy to intuit the management advantage a gymnastics school has when its spreads its numbers the way I suggest. It only takes one quick glance at the Tiddlywinks P&L to know it is being run efficiently. If it were not, that would show up quickly and we could devise proactive steps to reverse any bad trends.

I have now exhausted my accounting knowledge. As I wrote in Part 1, I was headed for an ‘F’ in Accounting 101 had I not dropped it. I may not know a lot, but what I do know I know very well and I know our Gross Profit Based accounting system has helped us better manage Kids First. I hope my ideas help you as well.

Warmest regards from Cincinnati, Jeff Metzger

Jeff is the founder of several industry-related businesses including Kids First Sports Center and the Small Business BOOT CAMP, a total-immersion leadership, marketing and management workshop for career-minded industry professionals. With graduates from every continent, BOOT CAMP has helped launch or catapult thousands of businesses. If you are serious about perpetual growth and profit for your business, BOOT CAMP should be MANDATORY TRAINING.